The tax pros are what make SDIRAs beautiful For several. An SDIRA is usually equally standard or Roth - the account variety you select will count largely with your investment and tax strategy. Check out using your economical advisor or tax advisor should you’re Doubtful that is ideal for you personally.

IRAs held at banking institutions and brokerage firms offer you minimal investment solutions for their shoppers mainly because they would not have the skills or infrastructure to administer alternative assets.

Have the liberty to invest in Virtually any type of asset using a risk profile that matches your investment strategy; which includes assets that have the prospective for a better level of return.

No, You can't invest in your own personal organization having a self-directed IRA. The IRS prohibits any transactions among your IRA as well as your personal company as you, as being the owner, are thought of a disqualified man or woman.

Opening an SDIRA can provide you with entry to investments normally unavailable via a financial institution or brokerage company. In this article’s how to begin:

An SDIRA custodian differs mainly because they have the suitable staff members, knowledge, and capacity to keep up custody in the alternative investments. The first step in opening a self-directed IRA is to find a supplier that is certainly specialised in administering accounts for alternative investments.

The main SDIRA regulations from your IRS that investors need to understand are investment limits, disqualified people, and prohibited transactions. Account holders should abide by SDIRA rules and restrictions in an effort to preserve the tax-advantaged standing in their account.

Buyer Assist: Hunt for a company that provides devoted assistance, such as access to professional specialists who will solution questions about compliance and home IRS principles.

Better Costs: SDIRAs typically include larger administrative expenses when compared with other IRAs, as specific elements of the executive approach cannot be automatic.

Set just, if you’re hunting for a tax effective way to develop a portfolio that’s much more tailored in your passions and abilities, an SDIRA could be the answer.

SDIRAs are frequently used by palms-on buyers who are willing to tackle the threats and tasks of choosing and vetting their investments. Self directed IRA accounts can also be perfect for buyers which have specialized expertise in a distinct segment sector which they would want to spend original site money on.

Entrust can aid you in buying alternative investments together with your retirement resources, and administer the acquiring and advertising of assets that are usually unavailable via banking companies and brokerage firms.

As soon as you’ve found an SDIRA company and opened your account, you may be wanting to know how to really commence investing. Understanding the two The foundations that govern SDIRAs, as well as the way to fund your account, may also help to put the muse for just a way forward for productive investing.

In contrast to shares and bonds, alternative assets in many cases are harder to sell or can include rigorous contracts and schedules.

In case you’re searching for a ‘established and overlook’ investing strategy, an SDIRA in all probability isn’t the best choice. Simply because you are in total Management over just about every investment produced, It can be up to you to carry out your individual homework. Bear in mind, SDIRA custodians are certainly not fiduciaries and can't make recommendations about investments.

Homework: It is termed "self-directed" for the reason. By having an SDIRA, you're fully accountable for carefully studying and vetting investments.

Right before opening an SDIRA, it’s crucial that you weigh the likely pros and cons dependant on your certain economical objectives and news possibility tolerance.

Confined Liquidity: Many of the alternative assets that can be held within an SDIRA, such as real-estate, personal equity, or precious metals, will not be very easily liquidated. This may be an issue if you need to entry cash swiftly.

Increased investment alternatives implies you are able to diversify your portfolio over and above stocks, bonds, and mutual funds and hedge your portfolio in opposition to marketplace fluctuations and volatility.

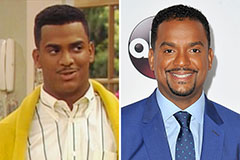

Alfonso Ribeiro Then & Now!

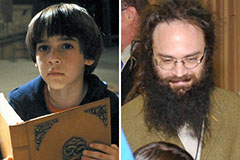

Alfonso Ribeiro Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!